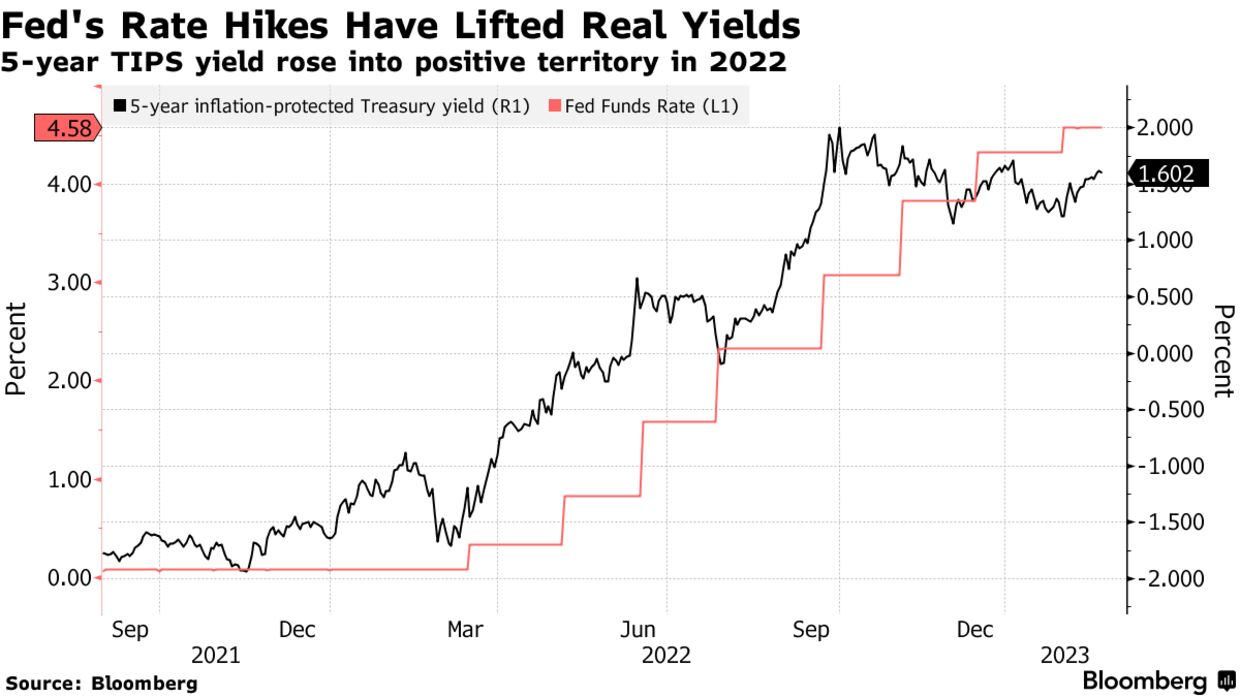

Global debt provides another negative for an already stretched equity multiple, JPMorgan says. Inflation ticked up again in August, putting more pressure on equities.

By admin

Global debt provides another negative for an already stretched equity multiple, JPMorgan says. Inflation ticked up again in August, putting more pressure on equities.

Interest rates, wars and even regional-bank troubles make the future more uncertain, JPMorgan CEO says

It comes after an analyst at JP Morgan warned the market will “turn south and get much worse”.

Six months have passed since the S&P 500 index touched its lowest level in more than two years after shedding about 25% of its value at the nadir of 2022’s bear market.

It’s been just about 23 years since the top of the internet bubble. Investors would do well to stop and reflect on this anniversary, even though few of us normally consider 23-year periods worthy of commemoration. But we can learn several important lessons about investing by analyzing performance since early 2000. The exact day on which the dot-com bubble was most inflated was March 10, 2000, when the Nasdaq Composite closed at 5048.62. The benchmark wouldn’t close above this level again until

There’s something of a ritual performed each time Federal Reserve Chair Jerome Powell speaks to the press: A reporter asks Powell about financial conditions; he says they’ve tightened a lot; the Wall Street crowd snickers.

Dallas, TX

American Network of Financial Education (ANOFE) was formed in 2020 in response to the Coronavirus that limited many pre-retires and retired persons from receiving timely and accurate information and education regarding retirement and income planning. Our experienced independent investment advisors and local licensed providers provide ongoing educational training workshops for our members, clients and their families.